Despite recent backlash from big business and finance firms and lobbies, Labour are pushing ahead with a leftward shift to crack down on corporate abuses, according to The Financial Times. In addition to charging that Conservatives have “totally failed” to take sufficient action on tax avoidance loopholes generally, Labour wants to target British tax havens:

On Friday [February 6, 2015], Ed Miliband, Labour’s leader, announced plans to put the UK’s offshore financial centres on a tax haven blacklist if they did not comply with a new transparency measures. But the plan was attacked as unworkable by [Chancellor] Osborne, who seized on it as further evidence that the Labour leader was “unfit to be prime minister”.

Well, I don’t know about that, Mr. Osborne, but it seems like trying to do something about the problem of offshore UK/crown tax havens (full story➚) is better than doing nothing. This is, after all, creating a lot of problems for other countries (see previous link), and British governments have repeatedly pledged to the international community to rein them in — and has singularly failed to do so.

Well, I don’t know about that, Mr. Osborne, but it seems like trying to do something about the problem of offshore UK/crown tax havens (full story➚) is better than doing nothing. This is, after all, creating a lot of problems for other countries (see previous link), and British governments have repeatedly pledged to the international community to rein them in — and has singularly failed to do so.

It will be interesting to see if Labour are willing to hold fast to their new position on corporate abuses — fully reasonable and sufficiently moderated positions, in my view — until the May elections or if they bend to pressure to be blindly (and fearfully) “pro-business,” as they arguably were in much of the “New Labour” years.

I say “interesting,” because I have a strong suspicion that the outcome of the internal Labour debate — between its working-class/progressive base and its City of London finance types — could prefigure the coming 2016 debates (if we have any) in the U.S. Democratic Party about whether to run on “middle class economics” or in Wall Street’s pocket.

There are certainly a lot of very clear parallels here, given the similarly outsized roles “The City” and Wall Street have taken on in both countries’ economies and politics, along with the controversial transformations of the New Democrats and New Labour led by Bill Clinton and Tony Blair respectively in the 1990s. While it may have worked in the short run, it has caused a great deal of problems for both parties in the longer run.

Moreover, in both countries, the center-left parties find themselves quickly abandoned by their respective financial districts for the conservatives — the natural home of Big Finance — when the winds change. Meanwhile, the under-served natural economic base of Labour and the Democrats drifts angrily, staying home on election day or seeking solace in fringe parties.

There is, of course, one other linkage of interest here. The tax evasion/avoidance problem — combined with various recent banking scandals — have given a new meaning to the phrase “special relationship” between the United States and the United Kingdom, given how often City and Wall Street firms seem to be tangled up in it together.

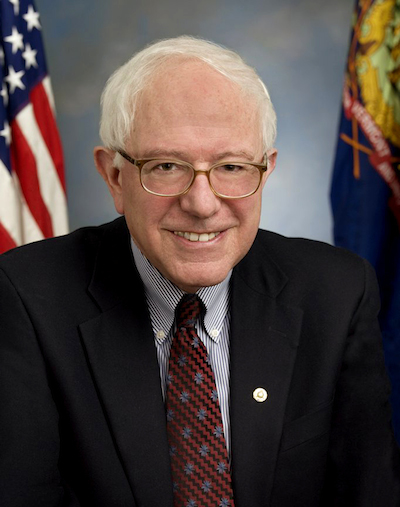

Senator Bernie Sanders has unveiled his latest policy proposal as part of his Democratic presidential campaign: Free public college, funded via a new financial transactions tax to discourage damaging Wall Street speculation. It’s a step up from his earlier

Senator Bernie Sanders has unveiled his latest policy proposal as part of his Democratic presidential campaign: Free public college, funded via a new financial transactions tax to discourage damaging Wall Street speculation. It’s a step up from his earlier

Well, I don’t know about that, Mr. Osborne, but it seems like trying to do something about

Well, I don’t know about that, Mr. Osborne, but it seems like trying to do something about