Guest essay by Heather R. Andrews: Broken promises as a prepaid debit card pitched, with hip-hop cred, to poor consumers breaks down.

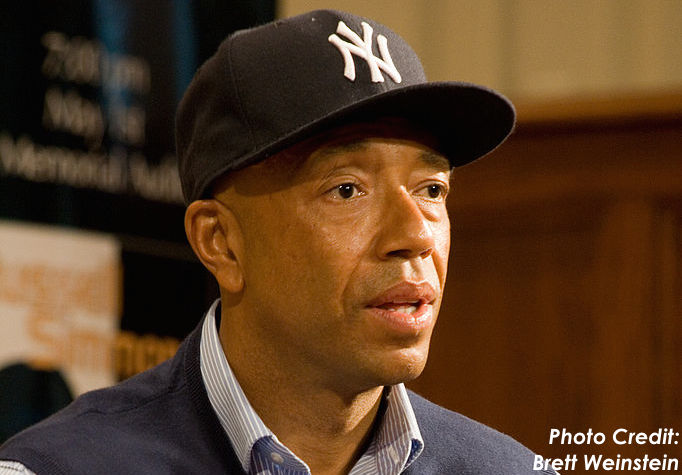

Def Jam co-founder and RushCard promoter Russell Simmons.

October 12th, 2015 marked the beginning of what can only be described as a nightmare for customers of a prepaid debit card service called “RushCard,” which has been heavily promoted by early hip-hop mogul Russell “Uncle Rush” Simmons.

Customers often arrange for their paychecks to be deposited directly to the card accounts. Now, due to a “software upgrade in the transaction processing system” – also described as a “glitch” or a “conversion” – customers have been experiencing a $0 balance on their cards or had no access to their funds.

For many of this particular card’s customers, being locked out of their account for days means they are not able to pay bills or buy essentials such as diapers, medicine, or food. Some customers are left with no other options and have resorted to crowdfunding.

Slowly the story has been percolating into mainstream media, but only minimally and very late. Lack of coverage, along with form letter style responses from Russell Simmons and RushCard employees, have only added to customers’ desperate frustration.

Customers have been instructed to send Simmons himself direct messages via Twitter to resolve their issues. Many customers created Twitter accounts to voice their concerns, receive assistance from any source available, and to DM Russell Simmons — as directed.

I have been tracking and boosting these messages for several days on Twitter. Card holders are tweeting about late fees, repossessions, utility disconnections. Along with the stories came pleas for Russell Simmons to do something. As of yet, no one is reporting that they have been assisted by Simmons or anyone on his team.

Simmons did issue an apology last Wednesday. In part:

“I want to personally reassure you that your funds are safe and that we are addressing every issue as quickly as possible. I deeply apologize for the hardship this is causing and give you my solemn commitment that we will fix these problems.”

As of yesterday, on day 9, customers were still waiting for Russell Simmons to fix those problems. Meanwhile, those funds remained unavailable for immediate use on bills and necessities.

So where did this problem come from? Not the technical problem, but rather the problem of a service with such a vulnerable consumer base that could ill afford a “glitch.”

RushCard/UniRush, a financial services company and one of the first providers of prepaid debit cards, was founded in 2003 by Russell Simmons, one of the co-founders of Def Jam Recordings and numerous other business ventures. By 2011, on the strength of claims that the card would financially empower its customers and promote financial literacy, UniRush had amassed a reported 1.5 million customers.

UniRush’s success has not been without its issues already. Even before this most recent problem, RushCard has come under fire for its high fees, bad customer service, and predatory marketing strategies.

Moreover, Simmons used his image and influence to appeal to the Black community. His target market specifically was “underbanked Americans.” The underbanked are low-income individuals and families with limited access to banking services by geographic location, credit history, discrimination, or other factors. These consumers were drawn in by UniRush promising no credit checks, $5.00 credits, designer logos, and the ability to receive direct deposits up to 2 days earlier. For the poorest Americans, already saddled with consumer debt and struggling to make ends meet, these little things could make a difference, however briefly. Read more