I’m getting real bored by all the libertarians on the internet who won’t stop rambling about “fiat currency” — money that is printed and not backed by precious metal or some other scarce commodity — like they’re privy to some dark conspiracy that no one else has been let in on.

I’m getting real bored by all the libertarians on the internet who won’t stop rambling about “fiat currency” — money that is printed and not backed by precious metal or some other scarce commodity — like they’re privy to some dark conspiracy that no one else has been let in on.

They manage to bring it up in almost any context, trying to explain any economic problem with it or waving away any economic progress as irrelevant in a world of fiat currency. It’s like the internet libertarian equivalent of Godwin’s Law, but instead of comparing something random to Hitler the discussion invariably trends toward derailment by reference to fiat currency.

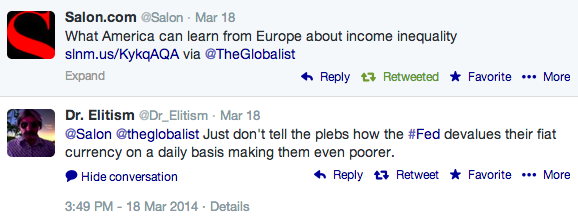

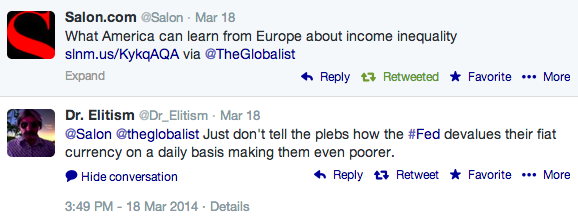

Here’s an example I recently saw where someone manages to link something that’s basically irrelevant to this:

You can see comments like that all over the internet these days, usually apropos of almost nothing.

We’ve been off the gold standard since the Nixon Administration. The world hasn’t ended. Might be time to let that particular obsession drop.

Aside from all the huge economic problems that result from tying currency to a gold standard or any other non-“fiat” system (which is why we stopped using it), the endless hand-wringing about it is based on a false premise that money is worthless unless back by some commodity or is literally made from it. Money does not derive its true value from what it’s made of and never has. Its power has always been more from the public confidence in and strength of the government backing it.

If everyone is confident in the currency and the government, it won’t collapse or rapidly erode in value. If those two confidences are missing…well, you have a lot more problems to worry about at that point than what the money is made of or backed by.

I’m getting real bored by all the libertarians on the internet who won’t stop rambling about “fiat currency” — money that is printed and not backed by precious metal or some other scarce commodity — like they’re privy to some dark conspiracy that no one else has been let in on.

I’m getting real bored by all the libertarians on the internet who won’t stop rambling about “fiat currency” — money that is printed and not backed by precious metal or some other scarce commodity — like they’re privy to some dark conspiracy that no one else has been let in on.